Q4 winter holidays are the #1 consumer spending event of the year //

Overall, holiday sales represent about 20 percent of annual retail sales each year, but the figure can be higher for some retailers.

Consumer Insights

The National Retail Foundation (NRF) lists the winter holidays as #1 on their list of top consumer spending events. Here’s what they learned about consumer buying plans in 2023.

How does it break down? Here are the top categories of gifts consumers want to receive in 2023: 1. Gift Cards 2. Clothing and Accessories 3. Toys 4. Books or Other Media 5. Personal Care or Beauty Items 6. Electronics 7. Home Decor 8. Jewelry 10. Sporting Goods 11. Home Improvement

Timing

43% of consumers plan to start their holiday shopping before November to spread out their budgets and avoid the stress of last minute shopping.

According to the NRF, Super Saturday, the last Saturday before Christmas, has become the biggest shopping day of the year as consumers rush to take care of last minute gifts and take advantage of great deals.

From their 2020 survey, the NRF learned that 66 percent of holiday consumers will still be shopping the week after Christmas. “The top reasons consumers plan to shop during the last week of December are to take advantage of post-holiday sales and promotions (45 percent) and use gift cards (27 percent).”

Marketing Resources

Spark ideas your promotional content and marketing materials with resources for the following holidays:

Hanukkah

Kwanzaa

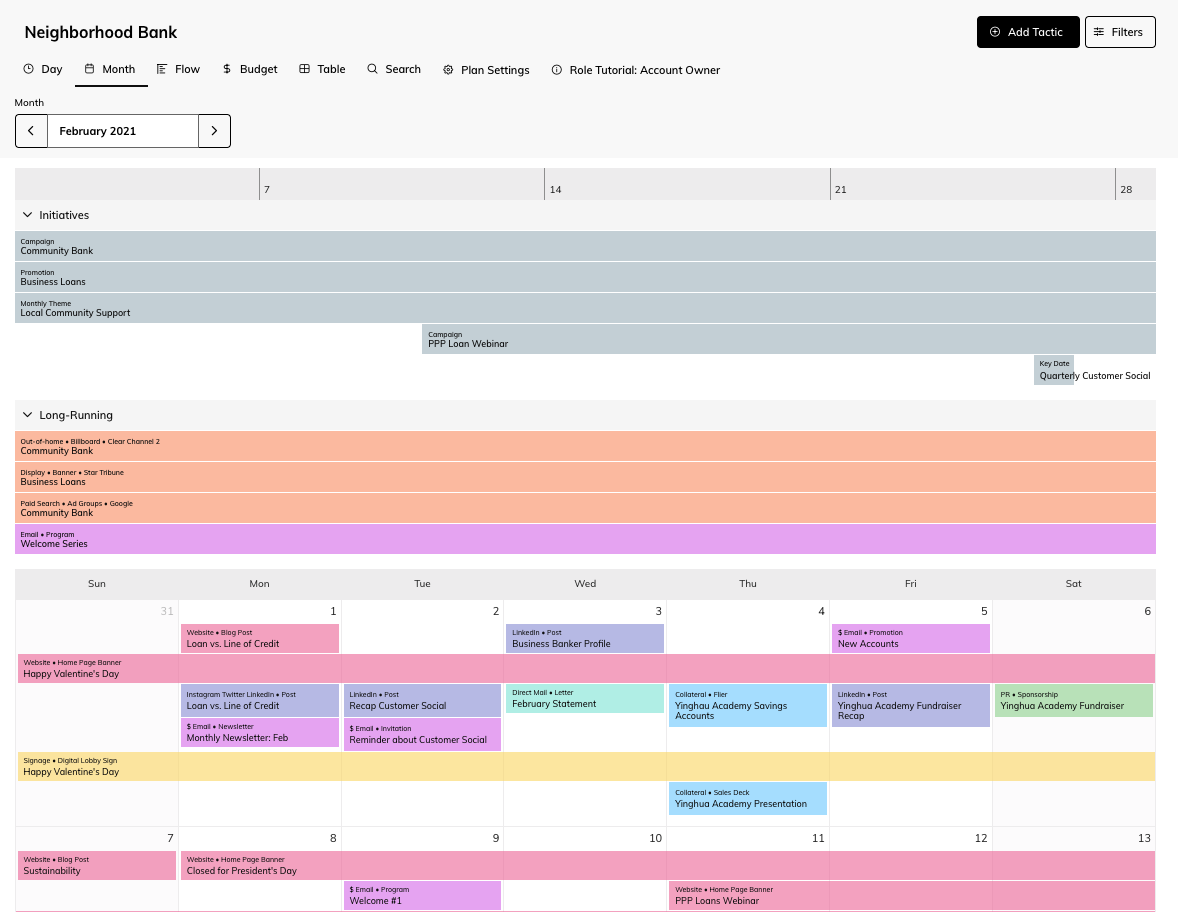

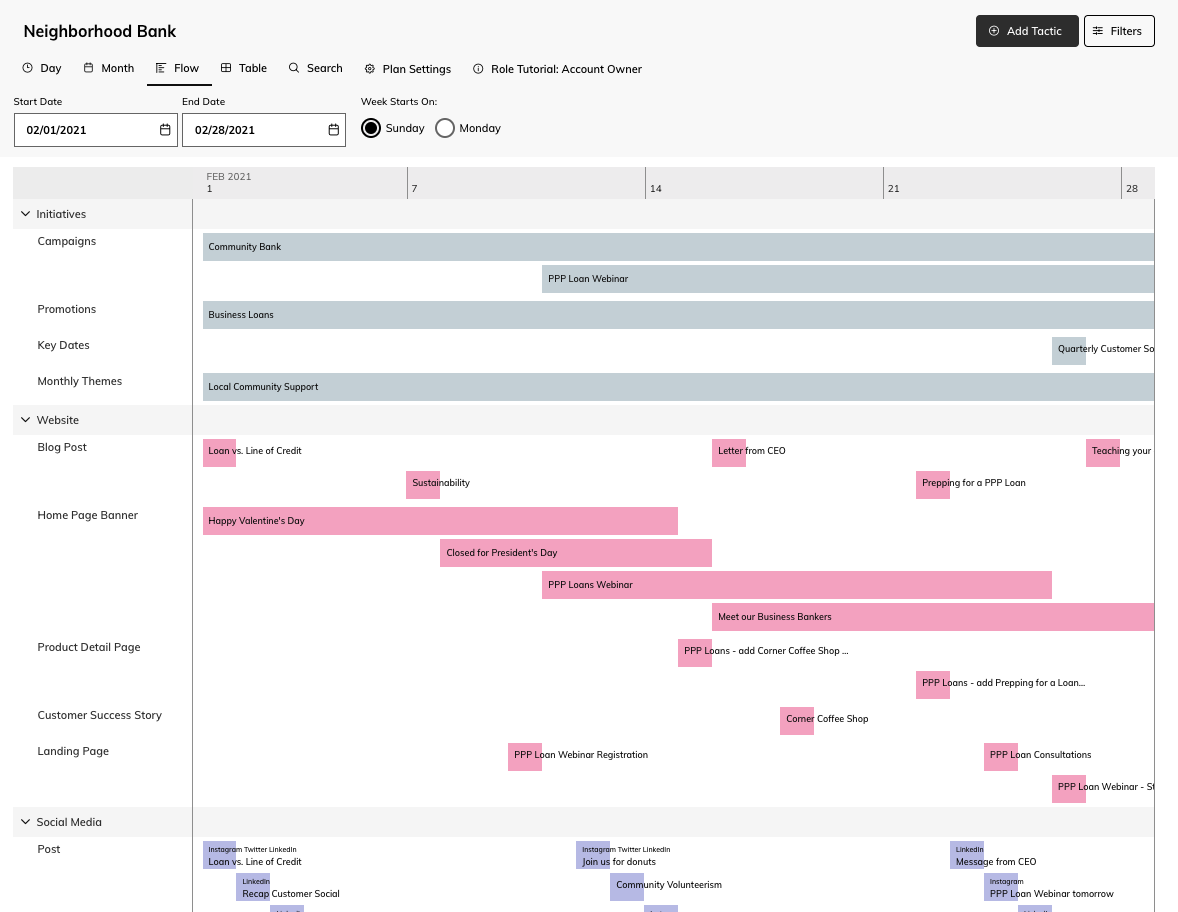

Plans spread across a hodgepodge of printed calendars and spreadsheets?

Struggling to get a clear view of everything in market? We've been there and we believe that plans siloed by channel, project, and campaign, are holding marketers back from delivering cohesive and compelling omnichannel customer experiences that drive more revenue.

That's why we founded Annum.

Annum's Integrated Marketing Planning Calendar

Bring all channels, content, online and offline tactics into one unified view. Filter by campaign, target audience segment, and more to identify gaps and opportunities and build stronger integrated plans. Annum serves as a historical plan of record so you can learn, adapt, and optimize your efforts.

Stay focused and on schedule with your marketing efforts.

Get printable calendars of holidays with associated insights delivered to your inbox right when you need them.